Patterns of Meta-Investment in Private Equity

/Extracted 28NOV2011 from http://www.pitchbook.com/library.html

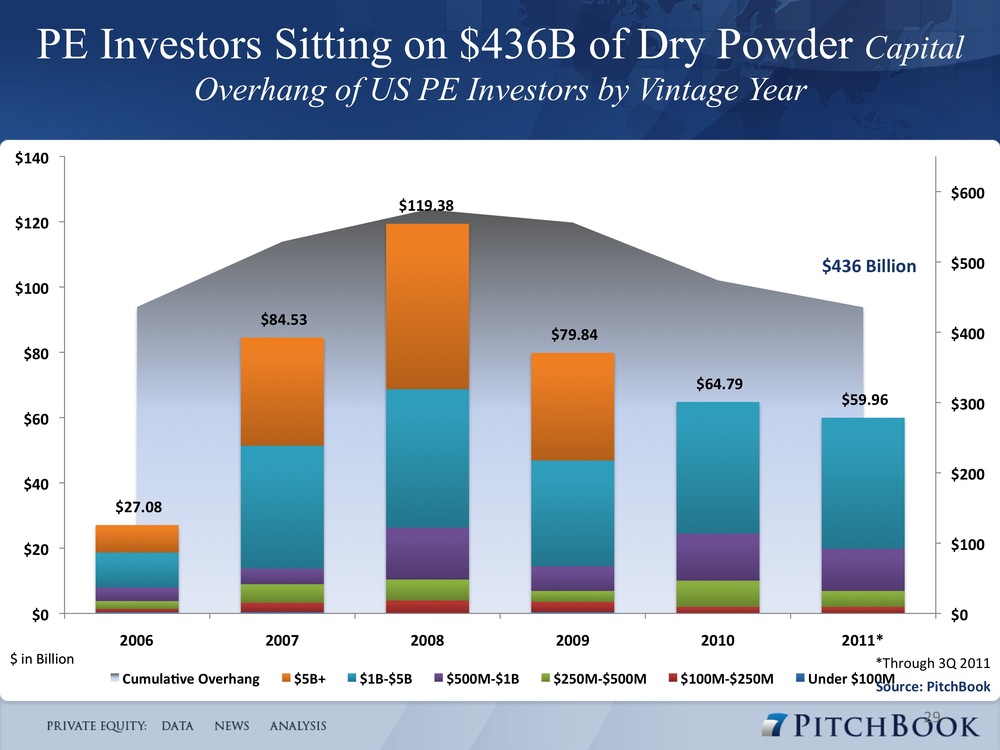

One encouraging trend seen this year has been the ability for private equity funds of all sizes to raise capital, with the exception of the mega funds (over $5 billion). Middle-market PE funds ($250 million-$5 billion) have been the biggest fundraisers so far in 2011, with 57 funds having raised a combined $64.5 billion. Fundraising activity will likely remain slow as private equity firms continue to work through the over $400 billion of capital overhang they have amassed over the last few years. The question for the future has turned into more of a when fundraising will pick up than an if, as PE firms continue to draw down the overhang while simultaneously returning capital via exits, putting them and their limited partners back in better fundraising/commitment shape. [Figures below show patterns over five years or more]

[It is interesting to speculate what these patterns imply, in aggregate, especially given the prominence of secondary buyouts summarized in the prior post extracted from the same site. Is this simply a conservative investment strategy or a manifestation of increased attention to the need for in-stride adaptation in current investments given rapidly changing and overlapping markets?]